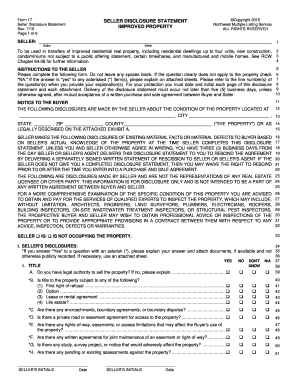

Get the free form 723

Show details

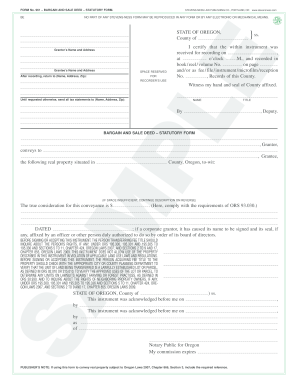

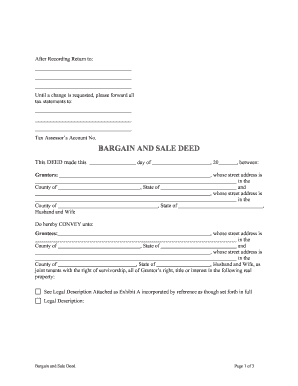

FORM No. 723 BARGAIN AND SALE DEED (Individual or Corporate). 1990-2010 STEVENS-NESS LAW PUBLISHING CO., PORTLAND, OR www.stevensness.com NO PART OF ANY STEVENS-NESS FORM MAY BE REPRODUCED IN ANY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 723 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 723 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 723 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bargain and sale deed individual or corporate form no 723. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out form 723

How to fill out form 723:

01

Start by reading the instructions provided with the form. It will outline the specific information you need to provide and any supporting documents that may be required.

02

Begin by filling in your personal information, such as your name, address, and contact details. Make sure to write legibly and accurately.

03

Proceed to the main sections of the form, which may ask for details related to your employment, income, or any specific circumstances that are relevant to the purpose of the form.

04

Double-check all the information you have entered on the form to ensure its accuracy. Any mistakes or missing information could cause delays or rejections.

05

If there are any supporting documents required, such as identification proofs or financial statements, attach them securely to the completed form.

06

Once you have reviewed everything, sign and date the form as instructed. Verify if any additional witness signatures or certifications are necessary.

07

Finally, make a copy of the completed form and all supporting documents for your records before submitting it to the designated recipient.

Who needs form 723:

01

Individuals or entities who are required to report specific information to the designated authority as per their legal or regulatory obligations.

02

This form may be needed for various purposes such as tax reporting, financial disclosures, or documenting certain transactions or events.

03

The exact requirement for form 723 may vary depending on the jurisdiction, industry, or specific circumstances of the individual or entity. It is essential to consult the relevant regulations or seek professional advice to determine if this form is needed in your case.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 723?

Form 723 is a form used by the Internal Revenue Service (IRS) to report and collect taxes on certain types of income. This includes income received from a trust, estates, partnerships, or an S corporation. Form 723 must be completed and submitted to the IRS when taxes are due.

How to fill out form 723?

Form 723 is the Application for a U.S. Treasury Tax Deposit and is used to make a tax deposit with the Internal Revenue Service (IRS). To fill out the form, you will need to provide the following information:

1. The type of tax deposit you are making (choose from Corporate, Employment, Excise, or Miscellaneous)

2. Your name, address, and employer identification number (EIN)

3. The amount of the tax deposit

4. The tax period for which you are submitting the deposit

5. The type of payment (electronic funds transfer or check)

6. The bank routing number and account number for electronic funds transfers

7. The date of the deposit

8. Your signature and date of signature

When is the deadline to file form 723 in 2023?

The deadline for filing IRS Form 723 is April 15, 2023.

What is the purpose of form 723?

Form 723 is used by the Federal Reserve Banks to report deposit liabilities and nondeposit borrowings of depository institutions to the Federal Reserve Board. It provides information on the average daily balances of transaction accounts, nonpersonal time deposits, and nondeposit borrowings of depository institutions for purposes of calculating reserve requirements and related charges.

What information must be reported on form 723?

Form 723 is used by federally insured depository institutions to report suspicious activities related to money laundering or other illegal activities to the Financial Crimes Enforcement Network (FinCEN). The information that must be reported on form 723 includes:

1. Financial institution identification: The name, address, and other identifying information of the reporting institution.

2. Filing institution contact: The name, position, and contact details of the person submitting the report on behalf of the institution.

3. Suspicious activity identification: A description of the suspicious activity in detail, including the involved parties, transactions, and any other pertinent information.

4. Narrative description: A narrative description of the facts and circumstances related to the reported suspicious activity.

5. Financial transaction information: Details of the financial transactions involved, such as amounts, account numbers, dates, and any other relevant information.

6. Subject information: Information about the individuals or entities involved in the suspicious activity, including their names, addresses, birthdates, social security numbers, and other identifying information.

7. Supporting documentation: Any supporting documents or records that substantiate the reported suspicious activity, such as copies of checks, wire transfer records, or any other relevant documents.

8. Law enforcement information: If the financial institution has reported the suspicious activity to law enforcement agencies, details of the report, including the agency name, case number, and date of the report.

9. Internal investigation information: Information on any internal investigations conducted by the financial institution regarding the suspicious activity, including the actions taken and the results of the investigation.

10. Record keeping: The form also includes a section to record the retention period for the supporting documents and other record-keeping requirements.

It's important to note that the specific requirements and instructions may vary, so it's recommended to consult the official instructions provided by FinCEN for the most up-to-date and accurate reporting guidelines.

What is the penalty for the late filing of form 723?

Form 723 is used by taxpayers to request an extension of time to file their federal estate tax return. If the form is not filed by the due date, penalties will be assessed. The penalty for late filing is typically 5% of the unpaid tax amount for each month or part of a month the return is late, up to a maximum of 25%. However, if the taxpayer can prove that the late filing was due to reasonable cause and not willful neglect, the penalty may be waived or reduced.

How do I make edits in form 723 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your bargain and sale deed individual or corporate form no 723, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the grantor form electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your form no 723 bargain and sale deed in minutes.

How can I edit form 723 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing bargain and sale deed individual or corporate form no 723.

Fill out your form 723 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grantor Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.